- MAIN TOOLS

- Standard Calculator

- Fractions Calculator

- Scientific Calculator

- Standard Deviation

- Percentage Calculator

- Loan Calculator

- Mortgage Calculator

- Unit Converter

- Feet Inches Calculator

- Temperature Calculator

- Area Calculator

- Time Calculator

- Currency Calculator

- Lease Calculator

- Basic Conversions

- text to binary

- binary to text

- decimal to binary

- binary to decimal

- binary to hexadecimal

- decimal to hexadecimal

- hexadecimal to binary

- hexadecimal to decimal

- decimal to octal

- octal to decimal

- binary to octal

- octal to binary

- hexadecimal to octal

- octal to hexadecimal

- OTHER

- Retirement Calculator

- Car Loan Calculator

- Age Calculator

- Tip Calculator

- Gpa Calculator

- Prime Numbers

- Investment Calculator

- Debt Reduction Calculator

- Credit Card Calculator

- Trigonometry Calculator

- Calories Burned Calculator

- Matrix Calculator

- Gas Mileage Calculator

- Volume Calculator

- Wind Chill Calculator

- Time Difference Calculator

- Circumference Calculator

- Molar Mass Calculator

- Download Time Calculator

- Convert Fraction to percent

- Percent Error Calculator

- Topsoil Calculator

- Arm Calculator

- Perimeter Calculator

- Hash Calculator

- Leap Year Numbers

- Frm Calculator

- Ovulation Predictor Calculator

- Room Area Calculator

- Quadratic Calculator

- Coin Problem Calculator

- Compound Names and Formulas

- Fibonacci Series Calculator

- Android Dpi Calculator

- Langelier Saturation Index Calculator

- Inelastic Collision Calculator

- Froude Number Calculator

- Fraction To Perentage Calculator

- Lead Time Calculator

- Pixel and Aspect Ratio Calculator

- Trignometric Angle Calculator

- Ratio Padding Calculator

- Planetary Age Calculator

- BMR Calculator

- BMI Calculator

- Conductivity Converter

- Digital Image Resolution Converter

- Electric Potential Converter

- Length Converter

- Linear Charge Density Converter

- Linear Current Density Converter

- Heat Transfer Coefficient Converter

- Henry's Law Unit Converter

- Unix Timestamp Converter

- Volume Charge Density Converter

- Reverse Text Generator

- QR Code Generator

- Blood Sugar Converter

- Luminous Energy Converter

- Magnetic Field Strength Converter

- Magnetomotive Force Converter

- Mass Flux Converter

- Specific Volume Converter

- Temperature Interval Converter

- Time Unit Converter

Mortgage Calculator

Monthly Pay: $2,626.57

| Monthly | Total | |

|---|---|---|

| Mortgage Payment | $2,626.57 | $472,782.39 |

| Property Tax | $400.00 | $72,000.00 |

| Home Insurance | $125.00 | $22,500.00 |

| PMI Insurance | ||

| HOA Fee | ||

| Other costs | $333.33 | $60,000.00 |

| Total Out-of-pocket | $3,484.90 | $627,282.39 |

| House Price | $400,000.00 |

|---|---|

| Loan Amount | $320,000.00 |

| Down Payment | $80,000.00 |

| Total of Mortgage Payments | $472,782.39 |

| Total Interest | $152,782.39 |

| Mortgage Payoff Date |

Payments

Mortgage Amortization Graph

Monthly Amortization Schedule

Annual Amortization Schedule

| # | Date | Beginning Balance | Interest | Principal | Ending balance |

|---|

| # | Date | No of Payments. | Beginning Balance | Interest | Principal | Ending balance |

|---|

| # | Date | Beginning Balance | Interest | Principal | Ending balance |

|---|

| # | Date | No of Payments. | Beginning Balance | Interest | Principal | Ending balance |

|---|

The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. There are options to include extra payments or annual percentage increases of common mortgage-related expenses. The calculator is mainly intended for use by U.S. residents.

Mortgages

A mortgage is a loan secured by property, usually real estate property. Lenders define it as the money borrowed to pay for real estate. In essence, the lender helps the buyer pay the seller of a house, and the buyer agrees to repay the money borrowed over a period of time, usually 15 or 30 years in the U.S. Each month, a payment is made from buyer to lender. A portion of the monthly payment is called the principal, which is the original amount borrowed. The other portion is the interest, which is the cost paid to the lender for using the money. There may be an escrow account involved to cover the cost of property taxes and insurance. The buyer cannot be considered the full owner of the mortgaged property until the last monthly payment is made. In the U.S., the most common mortgage loan is the conventional 30-year fixed-interest loan, which represents 70% to 90% of all mortgages. Mortgages are how most people are able to own homes in the U.S.

Mortgage Calculator Components

A mortgage usually includes the following key components. These are also the basic components of a mortgage calculator.

- Loan amount__the amount borrowed from a lender or bank. In a mortgage, this amounts to the purchase price minus any down payment. The maximum loan amount one can borrow normally correlates with household income or affordability.

- Down payment__the upfront payment of the purchase, usually a percentage of the total price. This is the portion of the purchase price covered by the borrower. Typically, mortgage lenders want the borrower to put 20% or more as a down payment. In some cases, borrowers may put down as low as 3%. If the borrowers make a down payment of less than 20%, they will be required to pay private mortgage insurance (PMI). Borrowers need to hold this insurance until the loan's remaining principal dropped below 80% of the home's original purchase price. A general rule-of-thumb is that the higher the down payment, the more favorable the interest rate and the more likely the loan will be approved..

- Loan term__the amount of time over which the loan must be repaid in full. Most fixed-rate mortgages are for 15, 20, or 30-year terms. A shorter period, such as 15 or 20 years, typically includes a lower interest rate.

- Interest rate__the percentage of the loan charged as a cost of borrowing. Mortgages can charge either fixed-rate mortgages (FRM) or adjustable-rate mortgages (ARM). As the name implies, interest rates remain the same for the term of the FRM loan. The calculator above calculates fixed rates only. For ARMs, interest rates are generally fixed for a period of time, after which they will be periodically adjusted based on market indices. ARMs transfer part of the risk to borrowers. Therefore, the initial interest rates are normally 0.5% to 2% lower than FRM with the same loan term. Mortgage interest rates are normally expressed in Annual Percentage Rate (APR), sometimes called nominal APR or effective APR. It is the interest rate expressed as a periodic rate multiplied by the number of compounding periods in a year. For example, if a mortgage rate is 6% APR, it means the borrower will have to pay 6% divided by twelve, which comes out to 0.5% in interest every month.

Costs Associated with Home Ownership and Mortgages

Monthly mortgage payments usually comprise the bulk of the financial costs associated with owning a house, but there are other substantial costs to keep in mind. These costs are separated into two categories, recurring and non-recurring.

Recurring Costs

Most recurring costs persist throughout and beyond the life of a mortgage. They are a significant financial factor. Property taxes, home insurance, HOA fees, and other costs increase with time as a byproduct of inflation. In the calculator, the recurring costs are under the "Include Options Below" checkbox. There are also optional inputs within the calculator for annual percentage increases under "More Options." Using these can result in more accurate calculations.

-

Property taxes__a tax that property owners pay to governing authorities. In the U.S., property tax is usually managed by municipal or county governments. All 50 states impose taxes on property at the local level. The annual real estate tax in the U.S. varies by location; on average, Americans pay about 1.1% of their property's value as property tax each year.

-

Home insurance__an insurance policy that protects the owner from accidents that may happen to their real estate properties. Home insurance can also contain personal liability coverage, which protects against lawsuits involving injuries that occur on and off the property. The cost of home insurance varies according to factors such as location, condition of the property, and the coverage amount.

-

Private mortgage insurance (PMI)__protects the mortgage lender if the borrower is unable to repay the loan. In the U.S. specifically, if the down payment is less than 20% of the property's value, the lender will normally require the borrower to purchase PMI until the loan-to-value ratio (LTV) reaches 80% or 78%. PMI price varies according to factors such as down payment, size of the loan, and credit of the borrower. The annual cost typically ranges from 0.3% to 1.9% of the loan amount.

-

HOA fee__a fee imposed on the property owner by a homeowner's association (HOA), which is an organization that maintains and improves the property and environment of the neighborhoods within its purview. Condominiums, townhomes, and some single-family homes commonly require the payment of HOA fees. Annual HOA fees usually amount to less than one percent of the property value.

-

Other costs__includes utilities, home maintenance costs, and anything pertaining to the general upkeep of the property. It is common to spend 1% or more of the property value on annual maintenance alone.

Non-Recurring Costs

These costs aren't addressed by the calculator, but they are still important to keep in mind.

-

Closing costs__the fees paid at the closing of a real estate transaction. These are not recurring fees, but they can be expensive. In the U.S., the closing cost on a mortgage can include an attorney fee, the title service cost, recording fee, survey fee, property transfer tax, brokerage commission, mortgage application fee, points, appraisal fee, inspection fee, home warranty, pre-paid home insurance, pro-rata property taxes, pro-rata homeowner association dues, pro-rata interest, and more. These costs typically fall on the buyer, but it is possible to negotiate a "credit" with the seller or the lender. It is not unusual for a buyer to pay about $10,000 in total closing costs on a $400,000 transaction.

-

Initial renovations__some buyers choose to renovate before moving in. Examples of renovations include changing the flooring, repainting the walls, updating the kitchen, or even overhauling the entire interior or exterior. While these expenses can add up quickly, renovation costs are optional, and owners may choose not to address renovation issues immediately.

-

Miscellaneous__new furniture, new appliances, and moving costs are typical non-recurring costs of a home purchase. This also includes repair costs.

Brief History of Mortgages in the U.S.

In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term. Only four in ten Americans could afford a home under such conditions. During the Great Depression, one-fourth of homeowners lost their homes. To remedy this situation, the government created the Federal Housing Administration (FHA) and Fannie Mae in the 1930s to bring liquidity, stability, and affordability to the mortgage market. Both entities helped to bring 30-year mortgages with more modest down payments and universal construction standards. These programs also helped returning soldiers finance a home after the end of World War II and sparked a construction boom in the following decades. Also, the FHA helped borrowers during harder times, such as the inflation crisis of the 1970s and the drop in energy prices in the 1980s. By 2001, the homeownership rate had reached a record level of 68.1%. Government involvement also helped during the 2008 financial crisis. The crisis forced a federal takeover of Fannie Mae as it lost billions amid massive defaults, though it returned to profitability by 2012. The FHA also offered further help amid the nationwide drop in real estate prices. It stepped in, claiming a higher percentage of mortgages amid backing by the Federal Reserve. This helped to stabilize the housing market by 2013. Today, both entities continue to actively insure millions of single-family homes and other residential properties.

More on DAHA Converter

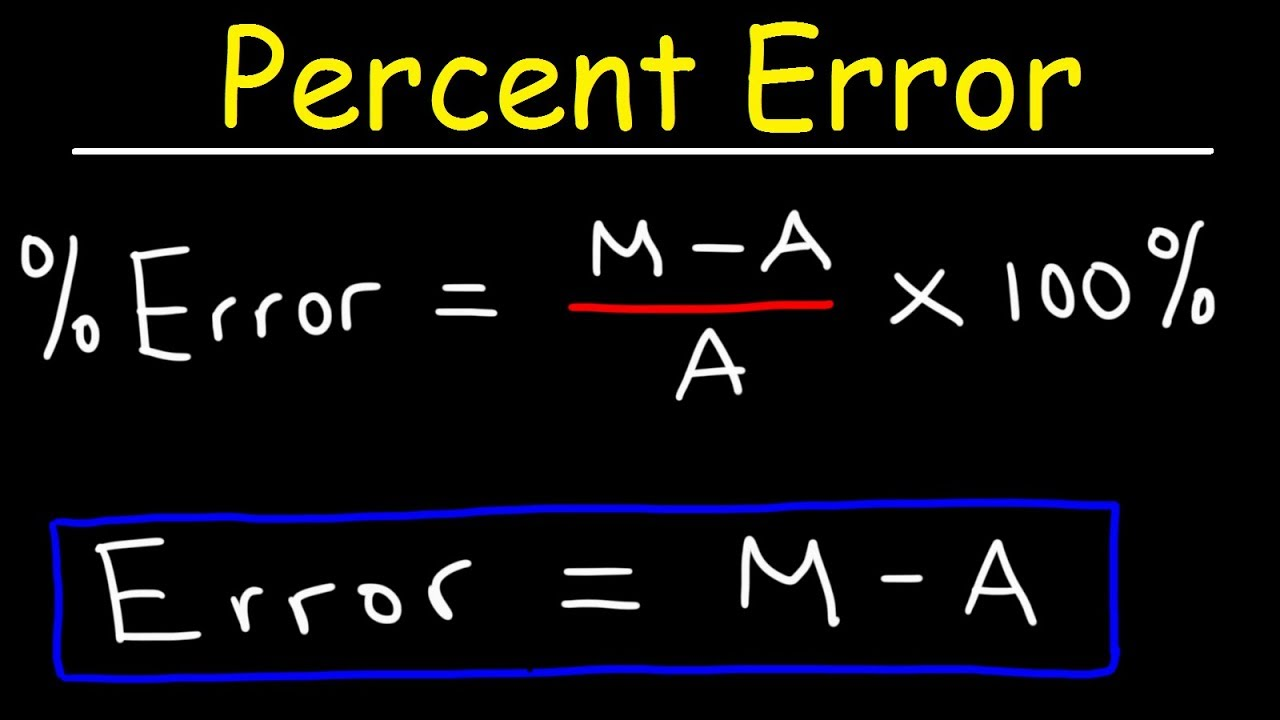

Guide to Using a Percent Error Calculator

<p>The Ultimate Guide to Using a Percent Error Calculator</p> <div class="header"> <h1>The Ultimate Guide to Using a Percent Error Calculator</h1> </div> <div class="cta"><a class="button" href="https://www.freeonlinecalculators.com/percent-error-calculator" target="_blank">Use the Percent Error Calculator</a></div> <h2>Introduction</h2> <p>Precision and accuracy are crucial in both scientific research and everyday measurements. The <a href="https://www.freeonlinecalculators.com/percent-error-calculator">percent error calculator</a> is a valuable tool that helps you quickly measure how close your results are to the theoretical values, saving you time and enhancing accuracy.</p> <h2>What is Percent Error?</h2> <p>Percent error quantifies the discrepancy between experimental results and theoretical values. It’s commonly used to assess the accuracy of measurements, expressed as a percentage.</p> <div class="example-box"> <h3>Formula for Percent Error:</h3> <pre> Percent Error = (|Experimental Value − Theoretical Value| / Theoretical Value) * 100</pre> </div> <p>For instance, if your experiment result is 98 and the theoretical value is 100, the percent error indicates how much your result deviates in percentage terms.</p> <h2>How Does a Percent Error Calculator Work?</h2> <p>The calculator automates this formula. Simply enter your values to get the percent error instantly.</p> <div class="example-box"><strong>Example:</strong> If your experimental result for the speed of sound is 340 m/s (with a theoretical value of 343 m/s): <pre> Percent Error = |340−343| / 343 * 100 = 0.87%</pre> </div> <h2>Why is Percent Error Important?</h2> <ul> <li><strong>Accuracy Check:</strong> Ensures your results are close to the accepted values.</li> <li><strong>Comparison Tool:</strong> Useful for comparing multiple measurements.</li> <li><strong>Error Identification:</strong> Highlights potential procedural or measurement errors.</li> </ul> <h2>Types of Percent Error Calculations</h2> <p>The percent error calculator helps determine if measurements meet target standards, commonly used in fields like <a href="/science-applications">scientific research</a>, <a href="/manufacturing-quality-control">manufacturing</a>, and <a href="/financial-forecasting">financial forecasting</a>.</p> <h3>Practical Examples</h3> <div class="example-box"> <p><strong>In the Laboratory:</strong> Measuring gravity with a result of 9.6 m/s² vs. an accepted value of 9.8 m/s²:</p> <pre> Percent Error = |9.6−9.8| / 9.8 * 100 = 2.04%</pre> </div> <div class="example-box"> <p><strong>In Manufacturing:</strong> A pipe with a theoretical diameter of 5 cm that measures 4.95 cm:</p> <pre> Percent Error = |4.95−5| / 5 * 100 = 1%</pre> </div> <h2>How to Use the Percent Error Calculator</h2> <ol> <li><strong>Enter Experimental Value:</strong> Input your measured result.</li> <li><strong>Enter Theoretical Value:</strong> Provide the accepted or correct value.</li> <li><strong>Calculate:</strong> The calculator will display the percent error instantly.</li> </ol> <h2>Advantages of Using a Percent Error Calculator</h2> <ul> <li>Provides quick results, essential for time-sensitive work.</li> <li>Reduces human error, especially with complex or repeated calculations.</li> <li>Applicable across multiple fields, enhancing reliability in various industries.</li> </ul> <h2>Common Mistakes to Avoid</h2> <p>While calculating percent error, avoid these common mistakes:</p> <ul> <li><strong>Forgetting Absolute Value:</strong> Always apply absolute value to ensure the error is positive.</li> <li><strong>Swapping Values:</strong> Ensure the theoretical value remains in the denominator.</li> <li><strong>Misinterpreting Large Percent Errors:</strong> Sometimes high errors reflect external factors rather than a calculation fault.</li> </ul> <h2>Conclusion</h2> <p>The percent error calculator is a vital tool for measuring and improving accuracy in science, engineering, manufacturing, and beyond. <strong>Visit <a href="https://www.freeonlinecalculators.com/percent-error-calculator">Free Online Calculators</a></strong> today to simplify your percent error calculations!</p> <div class="cta"><a class="button" href="https://www.freeonlinecalculators.com/percent-error-calculator" target="_blank">Start Calculating Percent Errors Now!</a></div>

<p>The Ultimate Guide to Using a Percent Error Calculator</p> <div class="header"> <h1>The Ultimate Guide to Using a Percent Error Calculator</h1> </div> <div class="cta"><a class="button" href="https://www.freeonlinecalculators.com/percent-e.... Read More

Lease Calculator

Reviews

Functions High Enough For Me

Look, this is not my first calculation website. I think I've been around long enough to know a thing or two. This is a perfectly fine website with almost containing all type of calculators . I'm proud to recommend this handsome product. I think you will be too..

A Great Tool

I've used Daha Converter for over a year now and am overall quite happy with it. Users on our site like the interactive functionality, and I like that I can customize the look locally with CSS (great for mobile responsiveness). Good tool - a little pricey, but mostly worth it..

A Great Value

Very quick and very easy, would not use anyone else.